In-Car Listening Insights: What the Research Tells Us

We’ve compiled key research from across Europe and Australia to create an in-depth guide to listeners’ in-car entertainment habits and preferences. This comprehensive overview provides valuable insights for the radio industry and automotive sector.

Key Findings

Radio Remains Dominant

Across all markets studied, radio continues to be the primary audio choice for in-car entertainment:

- 78% of drivers listen to radio at least weekly in their car

- 65% say radio is their most-used in-car entertainment source

- 82% consider easy radio access “important” or “very important” when buying a car

Changing Behaviours

While radio remains strong, listening patterns are evolving:

- Streaming services are growing but complement rather than replace radio

- Voice control usage for radio is increasing, particularly among younger drivers

- Podcast consumption in cars has grown significantly over the past three years

Regional Insights

United Kingdom

- DAB listening in cars has surpassed FM for the first time

- 91% of new cars sold include DAB as standard

- Radio accounts for 71% of in-car audio time

Germany

- Strong preference for public service radio stations

- Growing interest in hybrid radio (FM/DAB/IP) solutions

- High importance placed on audio quality

France

- FM remains the dominant platform, with DAB+ rolling out

- Strong loyalty to national and local stations

- Increasing use of manufacturer infotainment apps

Australia

- DAB+ available in all capital cities

- Strong growth in podcast listening during commutes

- Radio stations investing in digital streaming capabilities

Implications for the Industry

This research underscores several key priorities:

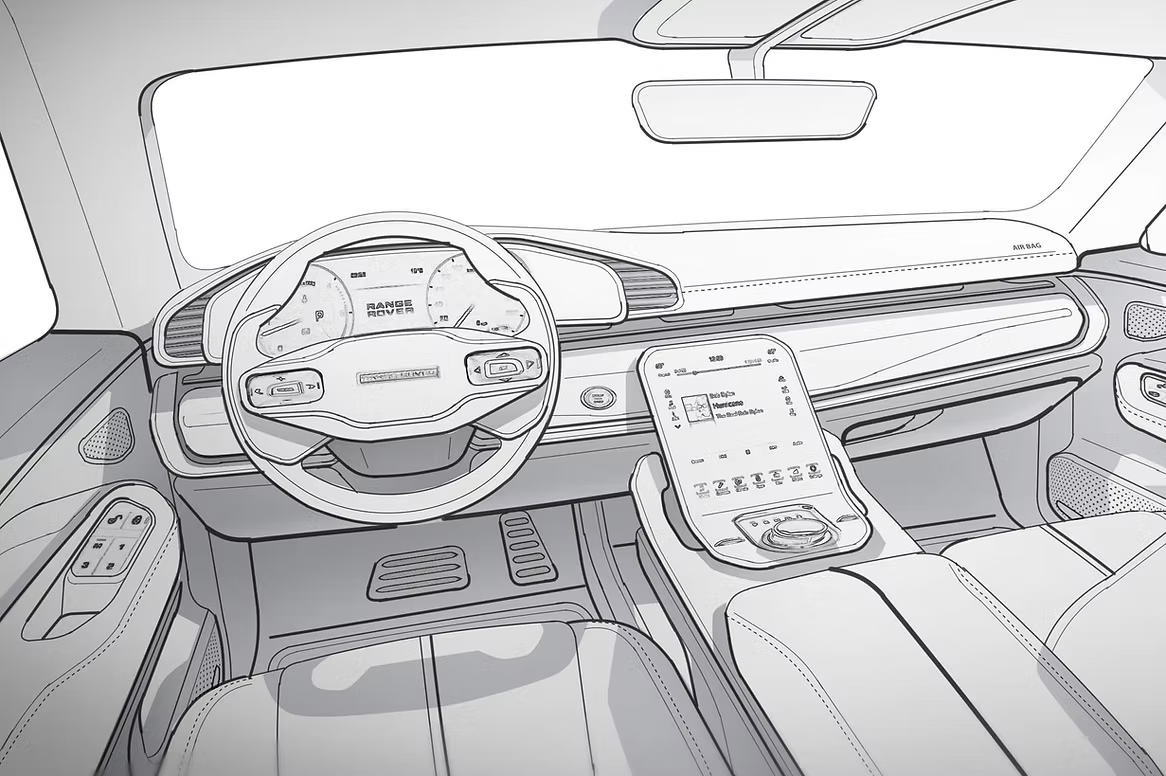

- Accessibility - Radio must remain easy to access in increasingly complex infotainment systems

- Hybrid Solutions - Supporting multiple delivery platforms (FM, DAB, IP) is essential

- Voice Integration - Natural voice control for radio is becoming expected by users

- Metadata - Rich programme information enhances the listening experience

“The data is clear: listeners want radio in their cars. Our job is to ensure they can access it easily.” - Radio Ready

For the full research reports, please contact Radio Ready to request access.